About one third of covered US consumers said they had experienced a rate increase in the last year. Across the United States, around one in three drivers with coverage experienced a rate increase within the last year, said a new JD Power 2023 US Auto Insurance Study. This has pushed them to look for new ways to save money on their policies that they might not have tried before. Mainly due to the rising expense associated with covering their vehicles, customer satisfaction with this coverage fell by 12 points to…

Read MoreTag: US auto insurance industry

Auto insurance companies could face another wonky year in 2022

According to a recent LexisNexis Risk Solutions report, the industry is showing “signs of revolution”. As 2022 reaches the point that its well underway, new analyses are starting to identify trends suggesting that auto insurance companies could be facing another bumpy ride. The trends appear to indicate that both shopping volatility and increased claims severity will continue. The analysis was conducted by LexisNexis Risk Solutions, which released a report indicating that auto insurance companies and the industry as a whole is facing a critical phase. Both heightened claims severity and…

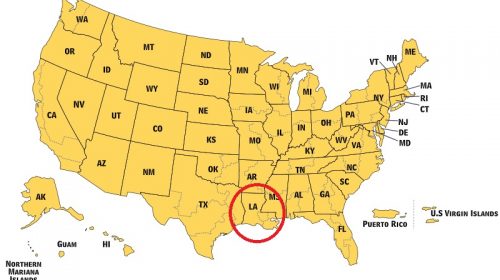

Read MoreThis state now has the most expensive car insurance (no, it’s not Michigan)

A new report has revealed that Michigan has broken its 7-year streak at the top of the high-priced list. Michigan has long been the state in which the drivers have had to face the most expensive car insurance premiums. However, according to the results of a new data analysis published in a report by insure.com, that state has now slipped into second place and a new one has taken the costly lead. As Michigan has stepped down into second place, Louisiana drivers now find themselves paying the most. Louisiana drivers…

Read MorePandemic-reduced Progressive auto insurance rates are getting hiked

As more drivers head back out onto the road again, the insurer is increasing the cost of coverage again. When the pandemic hit, sending drivers across Illinois home and leaving their cars in their driveways, Progressive auto insurance rates were lowered by about 10 percent. That said, drivers are heading back out again, and their premiums are also starting to rise. The insurer is increasing its rates by 4.2 percent for the majority of its customers in Illinois. The new Progressive auto insurance rates were filed with the Illinois Department…

Read MoreThe pandemic hasn’t stopped auto insurance claims satisfaction from rising

Consumers continue to be increasingly pleased with the quality of their experience, says JD Power. The pandemic hasn’t stopped steady improvements in auto insurance claims satisfaction from continuing this year. In fact, the reduced number of filings may have contributed to this trend. Fewer claims have given insurers the opportunity to fine tune their customer service. As a result, insurers are able to provide higher quality claims service, leading to improved auto insurance claims satisfaction among customers. The J.D. Power 2020 U.S. Auto Claims Satisfaction Study recorded a 22 percent…

Read MoreConsumer groups call for higher auto insurance rebates in the US

The Consumer Federation of America and Center for Economic Justice say insurers aren’t doing enough. The Consumer Federation of America (CFA) and the Center for Economic Justice (CEJ) have recalculated their figures for insurers and say auto insurance rebates are not large enough. Some insurers have issued discounts and credits to policyholders in the face of COVID-19. However, the CFA and CEJ have concluded that some of the largest insurers have fallen short of fairness in the auto insurance rebates they’ve issued in the United States. Both consumer groups calculated…

Read MoreTesla Insurance launches, sending the electric vehicle maker into a new industry

At first launch, the auto coverage will be available only in California and for the company’s customers. The Tesla Insurance coverage for the company’s electric vehicles and that was first announced earlier this year has now launched in California. The idea is to make premiums 20 percent to 30 percent more affordable for drivers of Tesla’s electric cars. Elon Musk first announced his intentions to launch the product back in April 2019. At that time, Elon Musk had assumed that the Tesla Insurance product would launch quite quickly. That said,…

Read More