More companies are beginning to embrace cyber insurance in order to guard against digital threats Cyber insurance is growing quickly in the United States, according to a new survey from the Council of Insurance Agents & Brokers. More companies are beginning to conduct business online, and this comes with significant risks that they may not be prepared to handle on their own. Consumer information is quite valuable, but many businesses have not had to protect digital information in any significant way in the past. As such, companies are beginning to…

Read MoreTag: united states

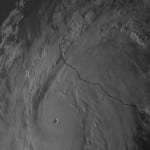

Mexico insurance industry expected to handle the impact of Hurricane Patricia

A.M. Best provides some insight into Mexico’s insurance industry A.M. Best, a rating agency based in the United States, has issued a comment concerning Mexico’s insurance industry and how it may be impacted by Hurricane Patricia. The powerful storm formed alarmingly quickly in the Pacific ocean and was the strongest hurricane ever recorded, with sustained winds recorded in excess of 200 miles-per-hour. While the storm dissipated quickly once making landfall, there are still serious concerns regarding flooding and the damage that heavy rainfall has caused. Insurers are expected to be…

Read MoreColorado health insurance co-op closes its doors

State’s co-op has failed to challenge and order to cease operations Colorado’s largest not-for-profit health insurance provider closed its doors earlier this week. Colorado HealthOP, the state’s co-op set up under the Affordable Care Act, did attempt to save itself from the state’s decision to shut it down, but was ultimately unsuccessful in the attempt. The Colorado Division of Insurance has ordered the co-op to stop writing new policies, citing serious financial issues that the insurer has been facing. The state’s co-op is one of several that will be shutting…

Read MoreDelays reported in upgrading the federal health insurance exchange network

Upgrades are being delayed, but are expected to be ready before the beginning of the open enrollment period Open enrollment for U.S. health insurance exchanges will begin November 1 this year and the federal government is working on improving its insurance gateway, HealthCare.gov. Earlier this month, the government announced that it would be making long-awaited upgrades to the website before the open enrollment period began, but these updates may be delayed somewhat. While federal officials believe that the updates will be online before the enrollment period begins, ongoing issues may…

Read MoreUS may miss targets for health insurance exchange enrollment

Government projections may be too ambitious Last year, the Obama administration declared the Affordable Care Act a success, as it had expanded the availability of health insurance coverage to some 8 million people throughout the United States. These people were able to find coverage through insurance exchanges, through which several private companies offered policies. Consumers also had access to subsidies from the federal government, which have made health insurance more affordable for many people. The success of insurance exchanges lead federal officials to believe that many more people would sign…

Read MoreEstimated 10 million people expected to enroll in health insurance exchanges by the end of the year

HHS predicts that many more people will enroll in state-based insurance exchanges by the end of this year The U.S. Department of Health and Human Services expects that some 10 million people will enroll for health insurance coverage through state-based exchanges by the end of this year. More than one-quarter of those without insurance in the country are expected to sign up for policies that suit their needs during the upcoming open enrollment period. The enrollment period is scheduled to begin on November 1, running through January 31, 2016. 8.8…

Read MoreHacks are causing cyber insurance rates to skyrocket

Insurers are raising premiums for the cyber insurance coverage that they provide Over the past two years, companies in the United States have been targeted by aggressive cyber attacks. This has prompted insurers to increase premiums on cyber insurance coverage by a massive margin. Some companies are perceived as being a high risk, which means that they are seeing higher costs when it comes to protecting themselves from digital attacks. Insurers are not just raising premiums on cyber insurance coverage, however, and many companies are looking for a solution to…

Read More