NAIC Proposes Bold Changes to Life Insurance Policy Illustrations to Enhance Transparency and Accuracy The National Association of Insurance Commissioners (NAIC) has unveiled a suite of updates aimed at improving the transparency and accuracy of life insurance policy illustrations. These changes will not only impact insurers but will also provide consumers with clearer expectations regarding policy performance. Here’s what you need to know about this potentially game-changing move for the life insurance industry. Why Life Insurance Illustrations Need an Overhaul Life insurance policy illustrations have long been a source of…

Read MoreTag: transparency

California Homeowners Face 34% Rate Hike as Allstate Follows State Farm’s Lead in Insurance Shakeup

LOS ANGELES: In a move that mirrors State Farm’s recent actions, Allstate is seeking a substantial increase in its California homeowners insurance premiums. First reported by the Los Angeles Times, Allstate aims to raise rates by an average of 34%, marking the largest rate hike in the state this year. If approved by the California Department of Insurance, this increase will impact over 350,000 policyholders. This latest development follows State Farm’s request for significant rate increases, including a 50% hike for renters and a 30% hike for homeowners. The six-largest…

Read MoreCalifornia Fair Plan Under Fire for Alleged Policy Violations

California Fair Plan Under Fire: Attorney Calls Policies “Criminally Restrictive” The California Fair Plan, designed as a last-resort insurance option for those unable to secure coverage elsewhere, is now under significant scrutiny. An Oakland attorney has spotlighted troubling issues impacting hundreds of thousands of policyholders. According to reporter Shandel Menezes from NBC San Diego, Attorney Dylan Schaffer of the Kerley Schaffer law firm has described the policies under the Fair Plan as “criminally restrictive” and asserts that selling these policies constitutes a misdemeanor under Insurance Code 2083. Schaffer claims that…

Read MoreCalifornia Insurance Commissioner Announces Game-Changing FAIR Plan Reform

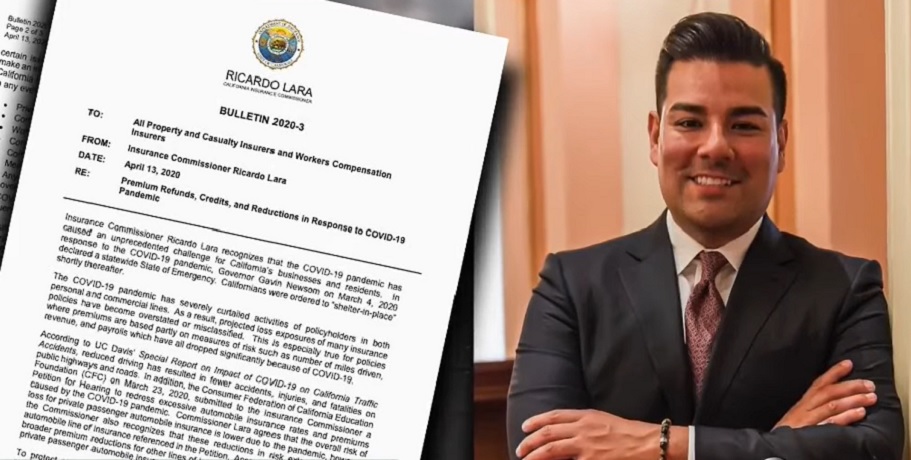

LOS ANGELES — In a significant move to address California’s ongoing insurance crisis,unveiled a breakthrough agreement to modernize the California FAIR Plan Association (FAIR Plan), the state’s “insurer of last resort.” This initiative is a key component of Lara’s Sustainable Insurance Strategy, marking the largest insurance reform since Proposition 103 was passed in 1988. Modernizing the FAIR Plan “Modernizing the FAIR Plan is a crucial step in our strategy to stabilize California’s insurance market,” said Commissioner Lara. “It’s critical for Californians to understand that a growing FAIR Plan contributes to…

Read MoreGen Z’s Truth About Lying: A Tech Revolution in Insurance

In an unexpected twist, the high rate of insurance application falsifications by Gen Z has become a catalyst for technological advancements within the insurance industry. NerdWallet’s 2024 Insurance Dishonesty Report reveals that 42 percent of Gen Z-ers have admitted to lying on insurance applications to secure better rates. This trend, while initially alarming, is driving significant innovation in how insurers handle data and assess risk. Generational and Gender Perspectives on Insurance Dishonesty Emerging trends highlight a generational and gender divide in attitudes towards insurance dishonesty. Men are generally more inclined…

Read MoreRevolution or Invasion? Automakers Sharing Driving Data with Insurance Companies

In the recent article titled, “Automakers Are Sharing Consumers’ Driving Behavior With Insurance Companies,” by the New York Times, the argument unfolds around the alliance between automakers and insurance firms. The central tenet of the paper uncovers a practice where car manufacturers transmit driving behavior data to insurers. This article explores the potential ramifications on insurance premiums, privacy concerns and consumer habits. The Impact on Insurance Premiums The sharing of driving data stands to revolutionize the insurance industry. On one hand, it can be a boon for safe drivers who…

Read More