2015 has been filled with natural disasters, placing pressure on Texas insurers This has been a troublesome year for many homeowners in the United States when it comes to natural disasters. In Texas, powerful storms have left many homeowners with damaged properties and the storms may have a significant impact on homeowners insurance overall. Insurers are expected to experience financial losses due to the high number of claims that have received as a result of the storms in Texas and this may lead to higher insurance premiums in 2016. Hail…

Read MoreTag: Texas

Report shows Texas is lagging behind in bringing health insurance to consumers

New report highlights the fact that Texas is falling behind the rest of the country when it comes to reducing the uninsured population Rice University’s Baker Institute for Public Policy and the Episcopal Health Foundation have released a new report that shows that the number of those without health insurance in the United States has dropped considerably between 2013 and 2015. Notably, however, Texas is lagging behind when it comes to decreasing its uninsured population. The report shows that, across the U.S., the number of uninsured consumers dropped nearly twice…

Read MoreHealth insurance scams are targeting consumers in Texas

Texas consumers are facing a new wave of scams that could leave them exposed to risks Low-income individuals living in Texas are being targeted by scams that seek to profit off their enrollment in the state’s health insurance exchange, as well as enrollment in HealthCare.gov. Enroll America, a non-profit organization offering free information concerning the enrollment process, has noted that there has been an increase in the sales tactics used to target low-income consumers. The organization suggests that many of these practices could actually be illegal as scammers are charging…

Read MoreHomeowners insurance rates in Texas are set to spike yet again

Homeowners in Texas will see an increase in their insurance premiums next year Residents of Texas are seeing their homeowners insurance premiums grow. The state is home to the third highest homeowners insurance rates in the United States, with the average annual premium being $1,745. The Texas Department of Insurance notes that these premiums have grown by more than 26% between 2010 and 2014. Only Florida and Louisiana have higher homeowners insurance premiums, on average. For some homeowners, premiums are growing by a greater margin than what others are seeing.…

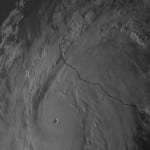

Read MoreMexico insurance industry expected to handle the impact of Hurricane Patricia

A.M. Best provides some insight into Mexico’s insurance industry A.M. Best, a rating agency based in the United States, has issued a comment concerning Mexico’s insurance industry and how it may be impacted by Hurricane Patricia. The powerful storm formed alarmingly quickly in the Pacific ocean and was the strongest hurricane ever recorded, with sustained winds recorded in excess of 200 miles-per-hour. While the storm dissipated quickly once making landfall, there are still serious concerns regarding flooding and the damage that heavy rainfall has caused. Insurers are expected to be…

Read MoreEmployer-sponsored health insurance is on the rise in Texas

Study shows that more workers in Texas are gaining health insurance coverage from their employers A new study from Rice University’s Baker Institute for Public Policy and the Episcopal Health Foundation has found that more people in Texas have employer-sponsored health insurance coverage. Many had been concerned that they would lose their sponsored covered due to some of the provisions of the Affordable Care Act. This has not been the case, however, as employers have opted to continue providing health insurance coverage for their workers. 68% of workers now receive…

Read MoreTexas has the largest population of those without health insurance coverage

Texas leads in terms of uninsured population, eclipsing California Texas now has the highest uninsured population of any state in the United States. Last year, the state had more than 5 million residents that did not have health insurance coverage, overshadowing even California in terms of its uninsured population. For many years, California was home to the largest uninsured population, with some 4.8 million people without coverage. Over the past few years, however, the state has managed to reduce its uninsured population by a significant margin. California has reduced the…

Read More