It’s no secret: health care costs are on the rise. According to the Commonwealth Fund, we can fault most of the costs associated with providing medical care for the rise in health insurance costs. To combat this growth, the Federal government, via the Affordable Care Act (ACA), has dedicated resources to increase the preventive and routine care to keep patients out of the hospital. But will these incentives actually work? Will wellness programs positively impact overall healthcare costs? Or will the costs of healthcare be shifted onto the employers and…

Read MoreTag: small group health insurance

Is an Administrative Services Only Plan Right for Your Firm?

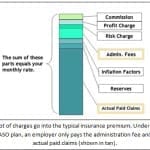

If you’ve ever braved the world of insurance quotes, you’ve probably run across the term Administrative Services Only (ASO) plans. Maybe you’ve heard about ASOs, but never knew what it entailed and if it was appropriate for your small business or organization. Under an ASO arrangement, an employer self-insures the benefits it pays out, but uses an outside company to deal with claims processing and paying providers. Simply put, an employer pays an insurance company or Third Party Administrator (TPA) to process claims based on a fee per person enrolled…

Read MoreHealth care reforms will place limits on costs paid by employees

Workers may no longer need to fear continuing spikes in out of pocket costs. In the pre-health care reforms environment, it had become a significant trend among small businesses to repeatedly hike deductibles and other costs that their workers were required to pay out of pocket in order to ensure that they would be able to continue to offer medical insurance in as coverage prices continue to rise. Now, the Affordable Care Act will limit the amount of cost that employers will be able to shift to workers. The federal health…

Read MoreHealth insurance group plans are 97 percent more expensive than in 2002

The price of medical coverage has been on a rapid climb throughout the last decade. A new national business survey has released its results this week, and it has shown that the cost of family health insurance through workplace plans has increased another 4 percent this year, while wages rose by only 1.7 percent. The survey was conducted by the Kaiser Family Foundation/Health Research & Educational Trust. The gap between the coverage sponsored by employers, and the salaries paid to the employees is considered even more significant when the trend…

Read MoreIndiana Health insurance may change the way smoking is factored into rates

Employers may be required to charge higher rates for plans covering smokers. Some employers in Indiana have already made the choice to charge higher rates for health insurance plans covering employees who smoke, but labor leaders are cautioning that this could lead to a trend where there is legislation against a larger number of health habits. The debate could impact the way that group rates are calculated within the state. The statewide ban on smoking has been into effect for several months, but there is now a hope among some…

Read MoreThings you might not know about group health insurance

Though most people feel that group health insurance – such as the plans offered by many employers – are highly beneficial, it should be noted that they were not all created equal, and that there are many surprising things that consumers can learn about those policies that might change their opinions about their value. Consider the following often unknown issues regarding group health insurance: • Some group health plans don’t provide pregnancy coverage – as a result of the Pregnancy Discrimination Act of 1978, the majority of health insurance plans…

Read MoreEmployees look to cancer insurance to fill the gap left by employers’ high deductible health coverage

Employers in California, as well as across the country, are attempting to cut the costs… associated with the skyrocketing medical insurance premiums by choosing higher deductible health coverage that shifts some of the expense to the employees. In response, many of those employees are looking to supplemental health plans like cancer insurance as a way to fill in the gaps that are being left behind by that employer sponsored insurance. Though these efforts were not very common as recently as two years ago, they are increasingly becoming the norm. That…

Read More