Growing Denials Leave Homeowners Vulnerable California’s homeowners faced significant challenges in 2023 as leading insurance companies denied nearly half of all claims, far exceeding the national average. A report by Weiss Ratings revealed that some of the state’s top insurers, including Farmers (50%), USAA (48%), and Allstate (46%), topped the list for denied claims. This comes as insurers deal with increasing exposures to climate-related disasters like wildfires, hurricanes, and flooding. While some insurers show alarming claim denial numbers, others demonstrate relatively better performance. Among these are two affiliates of AAA,…

Read MoreTag: insurance reform

Major Decision by Florida Court of Appeals Shakes Up Insurance Landscape

Florida Court Ruling Redefines Assignment of Benefits (AOB) and Its Impact on Homeowners Insurance A recent ruling by a Florida court of appeals has established that a “direction to pay” (DTP) by a policyholder does not equate to an “assignment of benefits” (AOB). This decision serves as a significant milestone reinforcing the legislative reform introduced through Senate Bill 2-A in 2023. The reform prohibits insurance policy benefits issued after January 1, 2023, from being assigned to third parties. The objective of Senate Bill 2-A is to curb the extensive litigation…

Read MoreBen Albritton’s Bold Stand Against Hurricane Claim Denials

Can Albritton’s Reforms Save Florida’s Homeowners? In a pivotal moment marked by his first address as president of the Florida Senate, Ben Albritton made it clear that the state’s property insurance companies were under scrutiny. His speech came at a crucial time, following the devastating impacts of Hurricanes Helene and Milton, which left many Floridians reliant on their insurance providers for recovery and rebuilding. Albritton, representing the Republican stronghold in Bartow, emphasized the need for insurance companies to honor their commitments to policyholders who have consistently paid premiums over the…

Read MoreConsumer Watchdog Demands Public Hearing on State Farm’s Proposed 30% Rate Hike

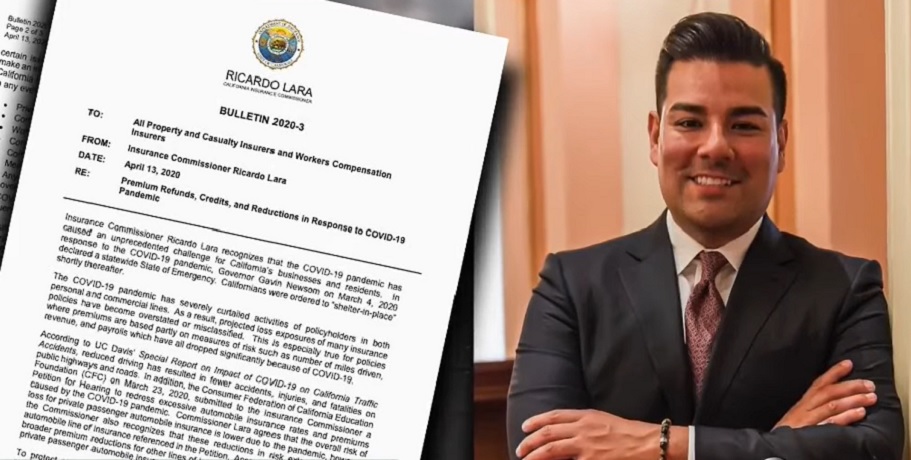

Consumer Watchdog Digging for Dirt in State Farm’s Backyard Consumer advocacy group Consumer Watchdog has called on California Insurance Commissioner Ricardo Lara to convene a public hearing regarding State Farm’s proposed 30% hike in homeowners’ insurance rates. The group contends that the proposed increase is intended to enhance the insurer’s financial stability rather than address anticipated claims, potentially resulting in a $5.2 billion burden on consumers. Concerns Over Financial Burden Consumer Watchdog’s petition, filed under Proposition 103, mandates a public hearing on rate increases when requested by the public. The…

Read MoreCalifornia Insurance Commissioner Announces Game-Changing FAIR Plan Reform

LOS ANGELES — In a significant move to address California’s ongoing insurance crisis,unveiled a breakthrough agreement to modernize the California FAIR Plan Association (FAIR Plan), the state’s “insurer of last resort.” This initiative is a key component of Lara’s Sustainable Insurance Strategy, marking the largest insurance reform since Proposition 103 was passed in 1988. Modernizing the FAIR Plan “Modernizing the FAIR Plan is a crucial step in our strategy to stabilize California’s insurance market,” said Commissioner Lara. “It’s critical for Californians to understand that a growing FAIR Plan contributes to…

Read MoreCalifornia Insurance Market Seeks Solutions Amid Homeowner Policy Crisis

California’s insurance landscape is poised for a substantial rewrite as authorities deal with the implications of devastating wildfires and market instability. With a pivotal public hearing on the horizon, Insurance Commissioner Ricardo Lara spearheads the effort to address the frustrations of both homeowners and insurers. The Plight of California Homeowners and Insurers Amid the ashes of devastating wildfires, Californian homeowners have faced soaring insurance premiums and widespread policy cancellations, driving the need for regulatory reform. A proposed overhaul by Commissioner Lara aims to streamline rate increase approvals and clarify regulations…

Read MoreCalifornia hearing focuses on workers compensation system

At a recent hearing in Sacramento of California’s Assembly and Senate brought focus to the state’s workers compensation insurance system. The hearing lasted for more than four hours, much of which was spent exposing the shortfalls of the state’s current system and highlighting the need for extensive reform. California’s Worker’s Compensation Institute (CWCI), a non-profit organization that writes worker’s compensation policies for the state, attended the hearing in order to share its views on the current problems facing the system and to discuss the issue of reform. During the hearing,…

Read More