Insurers are facing massive losses and have been withdrawing from areas prone to fires. The California wildfire risk has been causing problems for homeowners in the state that extend beyond the devastation left behind by the widespread uncontrolled blazes that are becoming increasingly problematic. As massive blazes become more commonplace, the cost associated with them is sending insurers away. Due to the California wildfire risk, insurers are falling out of love with the opportunity to insurer the properties there, particularly in areas most prone to the fires. “The marketplace has…

Read MoreTag: Homeowners Insurance

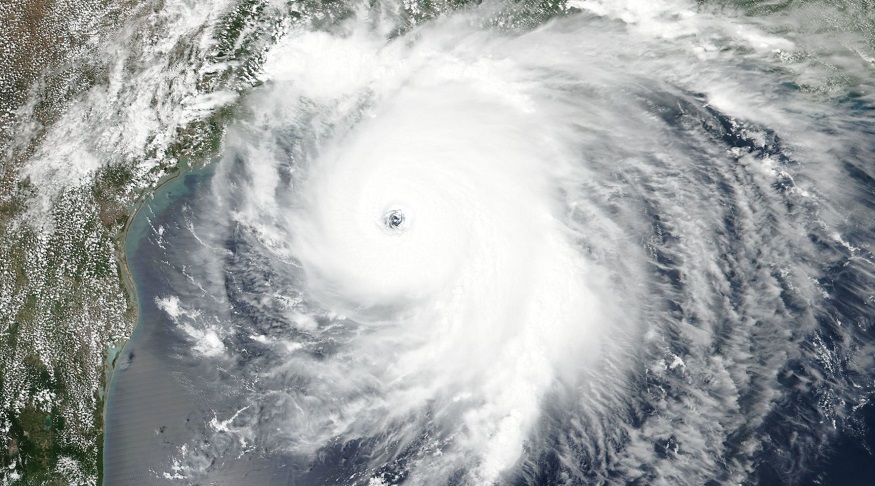

86 percent of homeowners think they have their hurricane preparedness under control

Many property owners aren’t taking into consideration the additional challenges from COVID-19. Even after the devastation left behind by the major storms last week, most homeowners feel they have made adequate hurricane preparedness efforts, according to a recent survey. When Hurricane Laura reached the US Gulf Coast, it struck as a highly powerful category 4. According to the research conducted by ValuePenguin, most homeowners – 86 percent – feel that the hurricane preparedness steps they have taken are enough. However, thousands of people who were in the path of last…

Read MoreWildfire prone property insurance bill in California due for hearing

The bill is expected to be heard in upcoming weeks as opposing sites prepare for major battle. A new California bill, the outcomes of which will have a lot to say about coverage for wildfire prone property in the state, will soon be headed for hearing. The hearing is expected to be a heated one as strong opposing opinions have the opportunity to be voiced. Opponents of this bill are calling it a direct attack on consumer protections in insurance. That said, proponents of the bill claim it is the…

Read MoreMorgan Stanley insurance offerings move into P&C coverage

The firm’s partner brokers will be offering wealthy clients these new coverage products. Morgan Stanley insurance products now include a range of P&C products designed for high net worth clients and their families. The brokerage has partnered with Marsh Private Clients Services, HUB International, and Willis Towers Watson to add to its available products. Support for the brokerage’s insurance clients will be provided through “dedicated service teams.” According to Barron’s, “dedicated service teams” will provide Morgan Stanley insurance customers with service. Clients will also be able to benefit from a…

Read MoreDoes Homeowners Insurance Cover Plumbing and Pipe Leaks?

Owning your own home is exciting but there are also basic chores and situations you need to be aware of. This will allow you to act in the best possible way should something negative happen. For instance, burst pipes which flood the house. Having your own home may mean that you have replaced the plumbing system and can feel fairly confident that you’re not going to have an issue. However, pipe leaks and plumbing disasters can happen to anyone at any time. It’s best to be prepared. Know Your Plumber…

Read MoreWill Homeowner’s Insurance Cover Hail Damage?

Since you’re living in “hail alley” in Denver, damage to your property due to this meteorological phenomenon kind of just comes with the territory. That being said, it doesn’t make the damage any less frustrating when you have to deal with it. Repairing places around your home, like your roof, can be a financial burden if you’re not appropriately prepared to handle the responsibility. There is a real need for hail preparedness, considering that parts of Colorado receive the “highest frequency of large hail in North America and most of the world.”…

Read MoreSecondary catastrophic perils on the rise from climate change, says Swiss Re

Global economic losses from disasters (natural and human-caused) last year reached $146 billion. Secondary catastrophic perils are rising in a measurable way as a result of climate change, said a recent Swiss Re Institute sigma. The sigma was titled “Natural catastrophes in times of economic accumulation and climate change”. Severe weather events were the primary driver of losses overall last year, as was the case in years prior. Last year, worldwide economic losses from disasters broke the $146 billion mark. This represented a fall from 2018’s $176 billion. The ten-year…

Read More