Fortified Roofs in Louisiana: A 22% Cut in Home Insurance Premiums For homeowners in Louisiana, the rising cost of home insurance has been a cause for concern, especially in hurricane-prone regions. However, fortified roofs are providing a glimmer of hope. Recent findings by the Louisiana Legislative Auditor reveal that upgrading to a fortified roof can slash home insurance premiums by an average of 22%, equating to annual savings of approximately $1,250. What Are Fortified Roofs? Fortified roofs are designed to withstand severe weather conditions, particularly high winds associated with hurricanes.…

Read MoreTag: home insurance crisis

Florida’s Home Insurance Crisis Deepens Amid Revelations of Financial Practices

Lawmakers Begin Scrutiny of Insurance Industry Practices Florida’s property insurance market has been a focal point of concern for years, with homeowners facing skyrocketing premiums and limited options. However, new information has surfaced, shedding light on financial practices within the insurance industry that raise serious questions about transparency. A report from March 2022, commissioned by the state’s Office of Insurance Regulation, has now become central to this discussion. Though it was completed over a year ago, it wasn’t made public at the time. It was only obtained recently through a…

Read MoreUnveiling the Housing Crisis – Where Homeowners Are Losing Insurance at Alarming Rates

Climate Change Sparks Surge in Dropped Home Insurance Policies The United States faces a quiet yet profound crisis as climate-related disasters reshape the home insurance market. According to a recent congressional investigation, more than 1.9 million home insurance contracts nationwide have been dropped by insurers since 2018. The practice of “nonrenewal” has surged, putting countless American homeowners in precarious positions. This shift has far-reaching consequences for mortgages, property values, and entire communities. Rising Non-renewals Expose the Insurance Housing Crisis Once considered a steady and predictable industry, the U.S. home insurance…

Read MoreCalifornia Faces Another Tough Blow as USAA Implements Steep Rate Increase

Significant Insurance Rate Hikes for USAA Customers in California California homeowners are facing significant financial adjustments as USAA Casualty Insurance Co. announces a sharp increase in insurance rates. Effective December 1, 2024, the company has implemented an average rate hike of 25.9%, with increases for some policyholders reaching a staggering 48.5%. This decision comes amid a broader pattern of rising insurance rates across California and reflects evolving challenges within the state’s already strained insurance market. Rate Increases Across USAA Subsidiaries The December rate hike is part of a wider adjustment…

Read MoreIs It Time for an ACA-Style Transformation in the Homeowners Insurance Market?

Exploring Critical Vulnerabilities in America’s Homeowners Insurance Market Recent events, including Hurricanes Milton and Helene, have highlighted significant vulnerabilities in the U.S. homeowners insurance market. These climate-induced disasters have added pressure to insurance providers, with the sector experiencing turmoil due to the increasing frequency and severity of such events. This has raised concerns over the financial security of millions of American homeowners. Florida is among the top 10 states with the highest number of uninsured homes. Between 15% and 20% of Florida homeowners currently lack property insurance. Home insurance premiums…

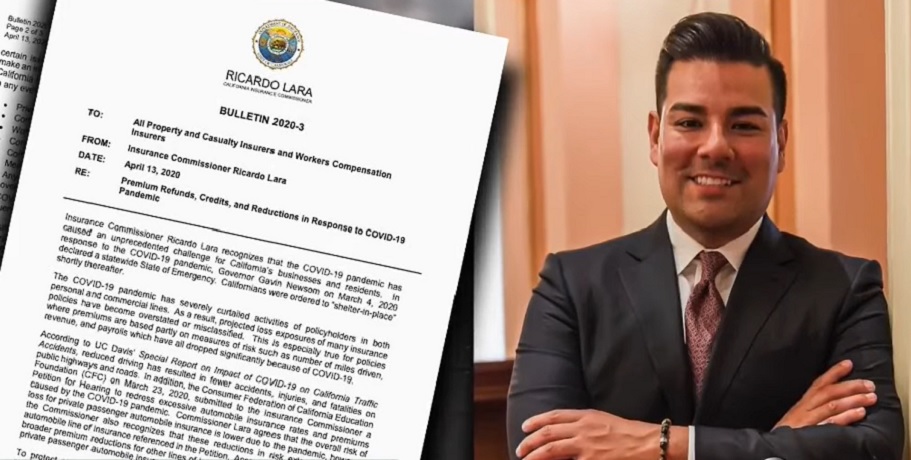

Read MoreCalifornia Insurance Commissioner Announces Game-Changing FAIR Plan Reform

LOS ANGELES — In a significant move to address California’s ongoing insurance crisis,unveiled a breakthrough agreement to modernize the California FAIR Plan Association (FAIR Plan), the state’s “insurer of last resort.” This initiative is a key component of Lara’s Sustainable Insurance Strategy, marking the largest insurance reform since Proposition 103 was passed in 1988. Modernizing the FAIR Plan “Modernizing the FAIR Plan is a crucial step in our strategy to stabilize California’s insurance market,” said Commissioner Lara. “It’s critical for Californians to understand that a growing FAIR Plan contributes to…

Read MoreNew bill introduced in California to help overcome homeowners insurance crisis

The federal bill was proposed by state Representative Adam Schiff (D-Burbank) last week. Last Wednesday, California Representative Adam Schiff (D-Burbank) introduced a new federal bill with the intention of leaving behind the crisis in the homeowners insurance market and propping it back up again following the exit of several insurers from markets across the country. The legislation is called the INSURE Act and would correct the issue through federal reinsurance. The INSURE Act stands for Incorporating National Support for Unprecedented Risks and Emergencies Act. The idea behind it is to…

Read More