New research shows that the National Flood Insurance Program is undercharging property owners. Florida flood insurance rates aren’t as high as they need to be to reflect the risk associated with the property, says the results of a recent study. It indicates that the National Flood Insurance Program is undercharging people and that it could justifiably raise its rates. Undercharging Floridians means that it is more affordable for people to live in dangerous locations. The Florida flood insurance rate findings were made following a new analysis by First Street Foundation.…

Read MoreTag: Florida insurance

Alien abduction insurance readily available to Florida residents

An insurer in the state sells a product for people concerned about UFOs and little green men. Whether or not you believe that beings from another world could take you away from the Earth, an alien abduction insurance can cover you, provided you live in Florida. An agency in the state is now offering limited and comprehensive policies against these abductions. St. Lawrence Agency owner Mike St. Lawrence in Altamonte Springs, Florida, created and sells a new type of coverage for its customers. This alien abduction insurance is being sold…

Read MoreFlorida health insurance program drops nearly 2k dependents without authentication

Governor Rick Scott has required that state employees provide more documentation to qualify for coverage. A $950,000 investigation into the Florida health insurance program has caused 1,825 dependents to lose their coverage. The audit required state employees to submit birth certificates in order to verify a child’s eligibility. Moreover marriages required an IRS tax return transcript for authentication. Nearly two thousand people have been taken off the state-employee health insurance program as a result. As workers failed to provide the necessary child birth certificates and tax documents, their dependents were…

Read MoreFlorida no fault car insurance repeal moves ahead in state Senate

Senator Tom Lee (R-Brandon) introduced the bill in the hopes of controlling skyrocketing premiums. The no fault car insurance bill meant to repeal the current system in Florida has cleared an important Senate committee. Should it become law, it would mean that drivers will need to purchase bodily injury coverage. The primary hurdle so far has been the argument that lawsuits and premiums would rise further. Many of the objections have come directly from insurance representatives. Should the no fault car insurance be repealed, it would mean that drivers in…

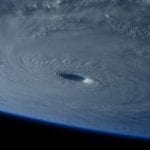

Read MoreHurricane Irma may force Florida’s private flood insurance market to prove its mettle

Residents of the state are preparing to protect their properties and loved ones against the approaching storm. As Hurricane Irma makes its way through the Caribbean and ever closer to Florida, the insurance industry is bracing itself. This is particularly true of the private flood insurance market in the state. Advocates say Florida’s market is a solid model for making federal flood insurance coverage more affordable. Should Hurricane Irma make landfall in Florida, as the hopes and prayers go out to residents for their safety and to avoid damage to…

Read MoreFlorida hurricane insurance preparation was effective, say officials

The state has said that insurers were responsive to their customers because they were ready. State officials have said that Florida hurricane insurance companies have been responsive to customers. This responsiveness to the damage from two hurricanes this year was the result of preparation. Those hurricanes caused hundreds of millions of damage in that state alone. These were the conclusions shared by the Florida Division of Consumer Services. That division received only 375 calls regarding the way Florida hurricane insurance claims were handled. When taking into consideration that Hurricane Matthew…

Read MoreWill 1.4 million people lose their health insurance plans in 2017?

As insurers withdraw from many exchanges, many Americans may find themselves scrambling for new coverage. A new study revealed that the impact of insurers stepping out of the Obamacare marketplaces could leave many Americans without health insurance plans. In fact, as many as 1.4 million people could lose their coverage and have to replace it by 2017. The states expected to be affected the most by insurance company withdrawal are North Carolina and Florida. Over the last few months, a rash of large health insurance companies have stepped out of…

Read More