Financial Fallout of a Missed Opportunity The New York Jets faced a significant financial setback when Aaron Rodgers tore his Achilles tendon just four snaps into the season. Without an insurance addendum in Rodgers’ contract, the team found itself unable to recover a portion of the $37 million in guaranteed money owed to the quarterback for 2023. This lack of foresight cost the Jets up to $22 million in potential insurance proceeds and deprived them of valuable salary cap relief. In the high-stakes world of NFL finances, the decision not…

Read MoreTag: financial stability

California Fair Plan Under Fire for Alleged Policy Violations

California Fair Plan Under Fire: Attorney Calls Policies “Criminally Restrictive” The California Fair Plan, designed as a last-resort insurance option for those unable to secure coverage elsewhere, is now under significant scrutiny. An Oakland attorney has spotlighted troubling issues impacting hundreds of thousands of policyholders. According to reporter Shandel Menezes from NBC San Diego, Attorney Dylan Schaffer of the Kerley Schaffer law firm has described the policies under the Fair Plan as “criminally restrictive” and asserts that selling these policies constitutes a misdemeanor under Insurance Code 2083. Schaffer claims that…

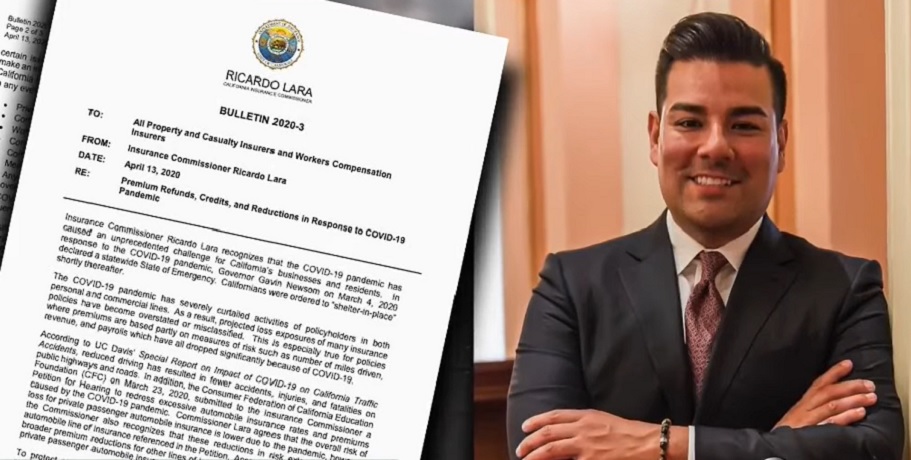

Read MoreCalifornia Insurance Commissioner Announces Game-Changing FAIR Plan Reform

LOS ANGELES — In a significant move to address California’s ongoing insurance crisis,unveiled a breakthrough agreement to modernize the California FAIR Plan Association (FAIR Plan), the state’s “insurer of last resort.” This initiative is a key component of Lara’s Sustainable Insurance Strategy, marking the largest insurance reform since Proposition 103 was passed in 1988. Modernizing the FAIR Plan “Modernizing the FAIR Plan is a crucial step in our strategy to stabilize California’s insurance market,” said Commissioner Lara. “It’s critical for Californians to understand that a growing FAIR Plan contributes to…

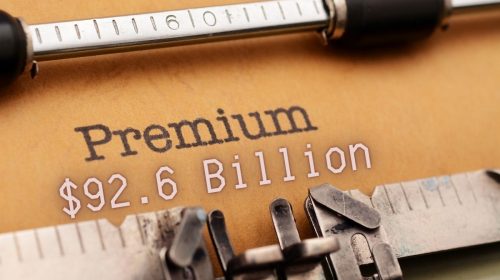

Read MoreState Farm Dominates and Soars to Top of AM Best Rankings with $92.6 Billion in Premiums!

State Farm has once again claimed the top position in AM Best’s rankings of US Property and Casualty (P&C) insurers for 2023, reinforcing its dominance in the market. The company’s total net premiums written (NPW) surged by an impressive 19.1% to $92.6 billion, further widening the gap between itself and its competitors. Dominance in the P&C Sector In the dynamic world of insurance, rankings can be both stable and surprising. Here, we explore the latest shifts among top US Property and Casualty (P&C) insurers, spotlighting substantial changes in Net Premium…

Read MoreState Farm Tech An Unseen Side of the Insurance Giant

State Farm Goes Beyond Insurance State Farm Insurance is widely known for its slogan, “Like a good neighbor, State Farm is there.” However, the insurance giant has gradually unveiled a different side to its business—technology. While many may associate State Farm with auto, home, and life insurance, the company is making significant strides in the tech industry, offering an array of patented innovations for sale. Which includes technologies ranging from auto telematics and smart home tech to unmanned aerial mission systems and adjustable virtual scenario-based training environments, has sparked a…

Read MoreGEICO Offers New Discounts Amid Rising Auto Insurance Rates

In a bold move to capitalize on increasing auto insurance rates across states such as California, GEICO Corp., part of Warren Buffet’s empire, is offering an attractive discount initiative, the “Welcome Factor,” aimed at expanding its auto insurance business. GEICO’s Fresh Approach to Auto Insurance With the surge in insurance rates, many insurers are taking a step back from writing new policies. However, GEICO is actively inviting new clients by marketing a special discount for those who apply for personal auto insurance. The discount is designed to taper off gradually…

Read MoreLloyd’s of London Braces for Historic Loss After Baltimore Bridge Disaster

The insurance industry, led by Lloyd’s of London, faces a potential record-breaking payout in the wake of the catastrophic Baltimore bridge collapse—a sobering reminder of the immense risks inherent in marine transport and infrastructure. A Behemoth of Insurance History for Lloyd’s of London Lloyd’s of London has long stood as an enduring icon in the insurance realm, demonstrating resilience amidst colossal claims. Among the most notable was the payout following the sinking of the Titanic, a testament to the enormity of marine risks that insurers like Lloyd’s contend with. The…

Read More