A December 2019 poll conducted by the University of Michigan revealed that around 50% of adults aged 65 to 80 go without dental insurance. The same poll, titled the University of Michigan National Poll on Health Aging, also found that cost is a main factor in choosing whether or not to opt-in to dental insurance — and that NOT having dental insurance is the main reason people choose to forgo needed dental care. Lack of Insurance Affects Ability to Get Proper Care The poll found that 1 in 5 adults…

Read MoreTag: dental insurance

Delaware dental insurance plan begins for low-income adults

October 1 marked the start of the additional coverage as a part of Medicaid across the state. Starting yesterday, adults in Delaware who receive Medicaid will automatically receive a dental insurance plan as a part of their coverage. Governor John Carney signed the legislation to make this possible back in August 2019. The dental insurance plan was originally scheduled to be added to Delaware’s Medicaid in April 2020. However, the COVID-19 pandemic delayed things until October 1, instead. Therefore, as of yesterday, people aged 19 through 65 years old who…

Read MoreWill dental insurance one day be key to mental health and Alzheimer’s prevention?

A new study has potentially linked gum disease with the development of this form of dementia. When consumers purchase dental insurance, it’s usually to help to prevent cavities or cover expensive oral procedures. That said, a new study has potentially connected the Alzheimer’s disease risk with a bacteria associated with gum disease. The study was published in the Science Advances journal, presenting a new understanding of dementia. Thought it’s too early for consumers to start rushing to buy dental insurance to help preserve their future cognitive function, this study has…

Read MoreToothbrush startup acquires dental insurance company for total tooth care

Quip has announced its intentions to purchase Afora, taking the next step in its unique business model. Electric toothbrush startup, Quip, is acquiring Afora, a dental insurance company. Quip first started selling its toothbrushes online back in 2015. It has, since that time, built a substantial consumer network. The toothbrush company offers subscriptions for direct-to-consumer personal care products. As popular as its toothbrushes have become, Quip is lining up to become more than a toothbrush brand. Instead, it is expanding to be able to become a dental insurance company, too.…

Read MoreDental insurance may be inadequate among adults with health plans

A recent survey showed that people aren’t buying plans that cover a trip to the dentist, due to cost. The results of a recent survey have now been released and they have shown that dental insurance is among the health care services that people with health plans say they most frequently skip due to the cost associated with the coverage. One in five adults said that they had dental care needs that were not being met because they were cost preventative. The research was conducted by at the Health Policy…

Read MoreChildren’s Dental Health Month: is your kid’s smile a healthy one?

February is a time that is dedicated to improving the oral health of children across the United States. February is Children’s Dental Health Month, and many different organizations, agencies, and individual dentist practices are making an effort to encourage parents and caregivers to make the right decisions for protecting the oral wellness of their kids. Tooth decay is the chronic disease that most commonly affects kids across the country. This, according to data from the American Academy of Pediatric Dentistry. This information is being shared throughout the United States for…

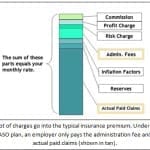

Read MoreIs an Administrative Services Only Plan Right for Your Firm?

If you’ve ever braved the world of insurance quotes, you’ve probably run across the term Administrative Services Only (ASO) plans. Maybe you’ve heard about ASOs, but never knew what it entailed and if it was appropriate for your small business or organization. Under an ASO arrangement, an employer self-insures the benefits it pays out, but uses an outside company to deal with claims processing and paying providers. Simply put, an employer pays an insurance company or Third Party Administrator (TPA) to process claims based on a fee per person enrolled…

Read More