About one third of covered US consumers said they had experienced a rate increase in the last year. Across the United States, around one in three drivers with coverage experienced a rate increase within the last year, said a new JD Power 2023 US Auto Insurance Study. This has pushed them to look for new ways to save money on their policies that they might not have tried before. Mainly due to the rising expense associated with covering their vehicles, customer satisfaction with this coverage fell by 12 points to…

Read MoreTag: car insurance coverage

Does auto insurance cover damage caused by potholes?

This time of the year is notorious for wreaking havoc on pavement, which can be damaging to vehicles. The weather across many parts of the country has reached the point when potholes are becoming a growing problem, and auto insurance companies are preparing for claims from drivers with damaged vehicles. Potholes often happen when cracks in pavement fill with water, which then freezes and expands. According to a recent report from State Farm, the first months of every year are the time in which potholes become more prominent. The temperature…

Read MoreHow much more do you pay in auto insurance after a crash?

Following an accident, most insurers will hike your monthly premiums by a certain amount. A car accident is never good news, but beyond the immediate issues it causes, it can also cause your auto insurance premiums to rise. That said, consumers often wonder how much more they will pay after suffering a car crash. Unfortunately, there’s no fast and solid answer to tell a driver precisely how much more they will pay for auto insurance after an accident. There are many different factors that are taken into consideration, including the…

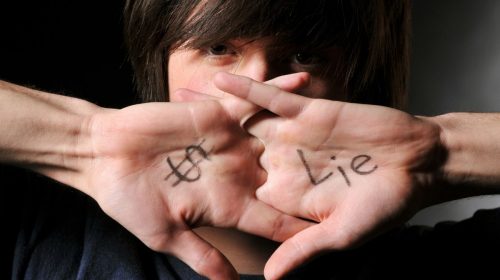

Read MoreLying on car insurance applications is common in the hopes of saving money

Research shows that Americans regularly lie on the details they submit to their insurers. Americans will often lie on their car insurance applications in the hopes of saving money, according to a Finder.com study. The data from the study showed that 35.8 million Americans fudge their details to get lower rates. The study determined that the 35.8 million people across the country lie on their applications to try to lower the car insurance premiums they must pay. Moreover, the number is considerably higher than what it was in 2020, when…

Read MoreFlorida has second most expensive auto insurance in the country

Drivers in the state spend a larger portion of their income on coverage than most other Americans. Florida auto insurance customers are paying more for their car coverage than nearly any other drivers in the United States. To keep their coverage, Floridian motorists must send more of their paychecks to pay their premiums. This, according to the data published in a new Bankrate.com report, suggests that Sunshine State residents are paying more of their income for their auto insurance than other drivers across the country. In fact, an average of…

Read More5 Tips To Help You Find A Good Car Insurance Plan In 2022

Buying a car insurance plan has become necessary in some places of the world. You might not be able to drive your car if you don’t have an appropriate insurance plan. But remember that if you are looking for a car insurance plan, you have to ensure that you gather proper details. Picking an insurance plan randomly won’t do any good to you. How can you ensure that you pick the right insurance plan if you have no prior experience of working with car insurance providers? Keep reading this article…

Read MoreDoes a small business need commercial auto insurance on a personal car?

Small business can use personal vehicles for work, but personal policies may not cover it. Commercial auto insurance also goes by a number of other names, such as business auto, commercial vehicle, commercial car, truck, or fleet insurance. The name depends on the type of vehicle being insured, but the concept is all the same. This type of policy protects you company from financial responsibility in the case of a collision. If an auto collision should happen, it’s the commercial auto insurance that protects the company from being financially responsible…

Read More