The research indicated that despite the fact that there are many women employed, they are not in these roles. According to the results that have recently been released from a study in the United States, the insurance industry is lacking in gender diversity across all leadership levels, even though there are a high number of women who have positions in the field. The study involved the data of 91 publicly traded companies as well as 9 mutual companies. The study was conducted by the team of primary author Mike Angelina,…

Read MoreTag: American insurance industry

Insurance industry report finally delivered by the Federal Insurance Office

Federal Insurance Office released long-awaited insurance industry report The U.S. Department of the Treasury‘s Federal Insurance Office has released a highly anticipated report concerning the insurance industry. The report was initially scheduled for release in January of 2012, but this release was delayed in order for the Federal Insurance Office to take better account of emerging trends in the insurance industry and provide better insight on how the industry has evolved over a relatively short period of time. The agency is tasked with providing these types of reports on an…

Read MoreInsurance industry in N.A. sees Canadian insurer sold to American company

Travelers has announced that it will be making the purchase for $1.25 billion in cash. The North American insurance industry has seen another major acquisition as an American insurer, Travelers Companies Inc. has just revealed that it is making a purchase of the Dominion of Canada General Insurance Co. This purchase is being made for a total investment of $1.125 billion to buy the company outright. The acquisition is being made as a part of the attempt Travelers would like to make to expand its presence in the Canadian insurance…

Read MoreInsurance industry could face losses of $5 billion from storms

American insurers may be facing a growing number of severe weather issues such as tornadoes. According to the disaster modeling company, Eqecat, the United States insurance industry could find that the insured losses from severe storms and tornadoes that occurred last week may come with a bill of $5 billion. The estimate from the firm falls within a range of $2 billion to $5 billion, with most linked to the Moore tornado. Though this is still quite early after the Moore, Oklahoma tornado from May 20, for the insurance industry…

Read MoreInsurance news from Swiss Re reveals Sandy and extreme weather loss estimates

The Superstorm and other disasters were found to have caused $77 billion in insured losses. The second largest reinsurer on the globe has issued its insurance news data regarding natural catastrophes as well as manmade disasters last year accumulated a cost to the industry of $77 billion. This makes 2012 the third most costly year that the industry has ever recorded. According to the Swiss Re insurance news report, there were over 300 different disasters and catastrophes last year. Together, they led to the loss of more than 14,000 lives.…

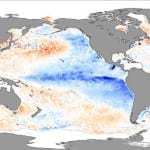

Read MoreInsurance industry becoming a fierce opponent of climate change

Insurance industry continues to consider climate change a problem The insurance industry has long been attuned to the potential threat represented by climate change. For some insurers, climate change is not an issue of debate, as they are primarily concerned with the intensity and frequency of natural disasters. Over the past two years, the insurance industry has seen trillions in losses associated with uncharacteristically powerful natural disasters, such as Hurricane Sandy, which struck the U.S. in late November. Though climate change remains a volatile subject in the world of politics…

Read MoreAmerican insurance industry feeling the pinch of weak investments and catastrophes

A new report released by A.M. Best Co. Inc., has stated that the unprecedented number of natural disasters, poor returns from investments, and an economy that continued to struggle in 2011, has made it exceptionally difficult for the American property and casualty insurance industry’s commercial insurance and reinsurance sectors to grow and has caused notable hurt to their operating performances. It’s estimated by the rating agency, based in Oldwick, New Jersey, that last year’s underwriting losses from underwriters in the commercial property and casualty sector were approximately $15.2 billion. This…

Read More