LOS ANGELES: In a move that mirrors State Farm’s recent actions, Allstate is seeking a substantial increase in its California homeowners insurance premiums. First reported by the Los Angeles Times, Allstate aims to raise rates by an average of 34%, marking the largest rate hike in the state this year. If approved by the California Department of Insurance, this increase will impact over 350,000 policyholders. This latest development follows State Farm’s request for significant rate increases, including a 50% hike for renters and a 30% hike for homeowners. The six-largest…

Read MoreTag: Allstate

Allstate’s National General Accused of Forcing Unnecessary Insurance on 2 Million Cars

The U.S. Department of Justice (DOJ) has filed a civil lawsuit against Allstate-owned National General, accusing the auto insurance brand of defrauding customers by force-placing unnecessary Collateral Protection Insurance (CPI) on vehicles financed by Wells Fargo. This lawsuit, filed in the U.S. District Court for the Western District of Pennsylvania, addresses fraudulent activities that allegedly occurred between October 2005 and September 2016. Allstate’s National General and The Forced Placed Insurance Allegations The DOJ claims that National General, which was acquired by Allstate in early 2021, imposed CPI on borrowers who…

Read MoreCalifornia Insurance Commissioner Announces Game-Changing FAIR Plan Reform

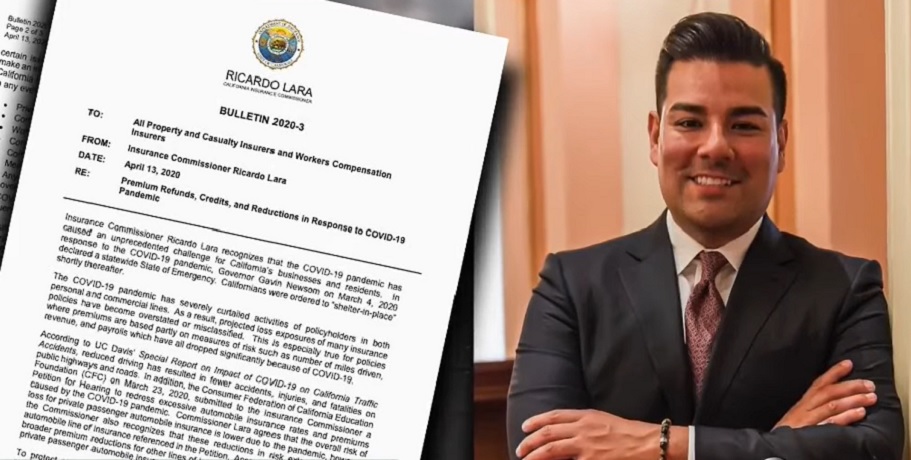

LOS ANGELES — In a significant move to address California’s ongoing insurance crisis,unveiled a breakthrough agreement to modernize the California FAIR Plan Association (FAIR Plan), the state’s “insurer of last resort.” This initiative is a key component of Lara’s Sustainable Insurance Strategy, marking the largest insurance reform since Proposition 103 was passed in 1988. Modernizing the FAIR Plan “Modernizing the FAIR Plan is a crucial step in our strategy to stabilize California’s insurance market,” said Commissioner Lara. “It’s critical for Californians to understand that a growing FAIR Plan contributes to…

Read MoreWho’s Responsible? California Faces New Rate Hikes from State Farm and Allstate

California homeowners and renters may soon face significant financial strain as two of the state’s largest insurers, State Farm and Allstate, announce hefty rate hikes. These increases come against a backdrop of escalating climate change impacts and urban expansion into wildfire-prone areas. Significant Increases from Major Insurers State Farm, the largest home insurer in California, has applied for substantial rate hikes across its various insurance lines. The company, which insures nearly one in five homes in the state, has requested a 30% increase for homeowners insurance, a 52% increase for…

Read MoreState Farm Faces Unprecedented Claims Surge as Hurricane Beryl Breaks Records

Hurricane Beryl Smashes Records, Unleashing Insurance Claim Surge Hurricane Beryl has left an unprecedented mark in its wake, driving State Farm to handle over 16,000 insurance claims—a record for the company. This surge in claims was set off when Beryl struck Texas, marking the first U.S. landfall of the 2024 Atlantic Hurricane season, according to a report by AM Best. The financial fallout from this historic storm is projected to reach into the billions, reflecting widespread damage to properties and vehicles across multiple states. Initially impacting the U.S. as a…

Read MoreAllstate Study: Discounts for Prepared Customers Could Save Millions

Economic Study Highlights Massive Savings Through Climate Resilience Investments As natural disasters become more frequent and severe, Americans face a growing number of billion-dollar calamities each year. A recent economic study by Allstate, in collaboration with the U.S. Chamber of Commerce and the U.S. Chamber of Commerce Foundation, reveals that proactive investments in climate resilience and preparedness could save both communities and insurers substantial sums. The study shows that for every dollar spent on resilience and preparedness, communities can save $13 in damages, cleanup costs, and economic impacts. This finding…

Read MoreAre auto insurance companies secretly spying on drivers with their phones?

Common apps may be feeding insurers more info than motorists think Auto insurance companies have been offering discounts to drivers who use their apps to track their habits behind the wheel and prove that they are safe while they’re on the road. Other apps may also be feeding information to insurers According to a recent Business Insider report, auto insurance companies are learning about drivers’ habits even if those motorists haven’t signed up to be tracked. The report stated that there is a slew of commonly used applications installed on…

Read More