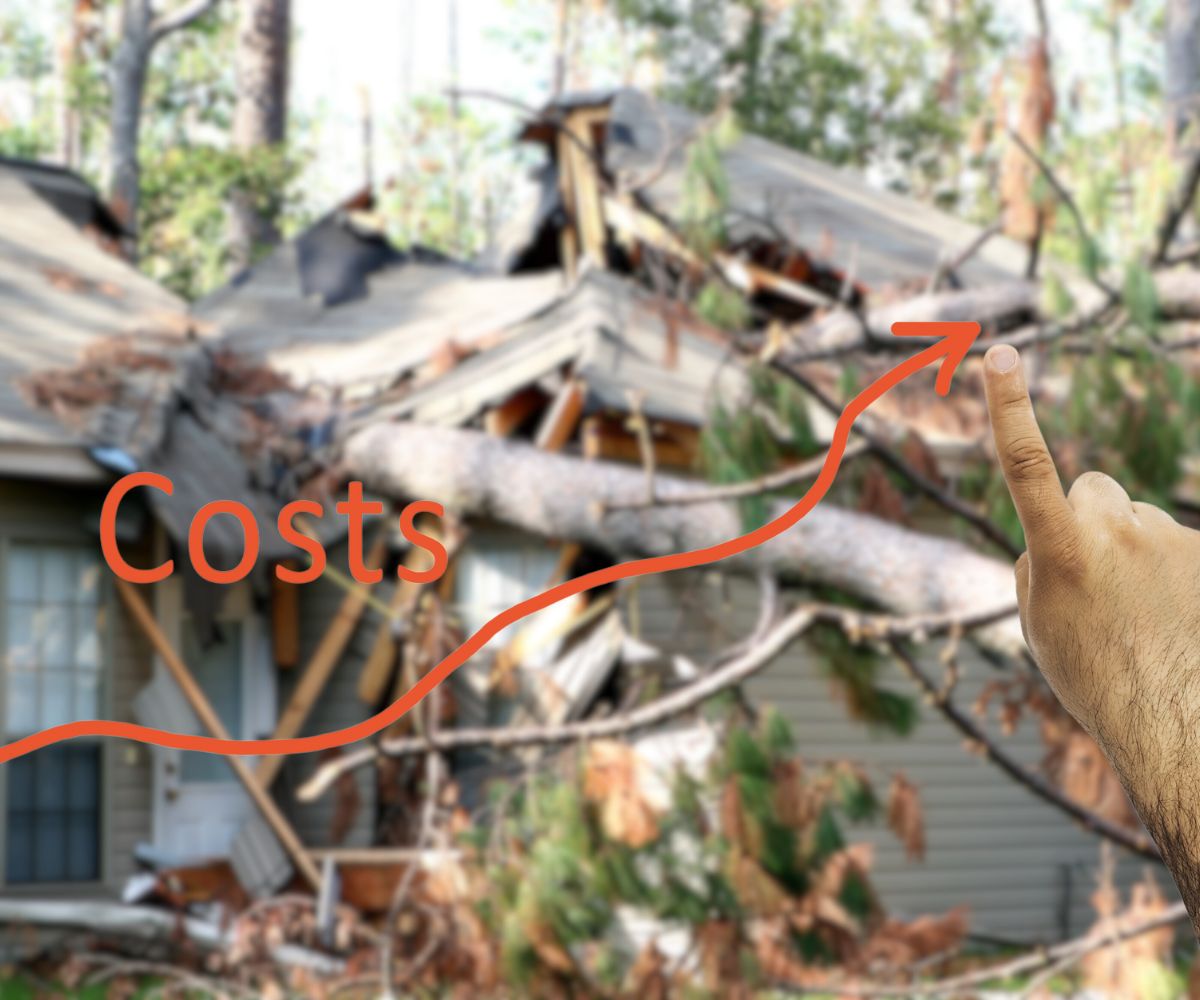

These secondary weather systems are striking areas across the US, leaving damage behind

While we tend to think of the most damaging weather that will impact home insurance as massive systems that take a long time to build and then stomp their way across the region, they’re not alone.

Severe-convective storms are what the industry calls “secondary perils”

The severe-convective storms, also known as kitty cat storms, are thunderstorms that build rapidly to the point of being large and powerful but disappear once again within a span of days or even hours. They’re highly volatile and tend to send out damaging elements such a hail or even tornadoes.

The central United States have been particularly affected over the last while and this is certainly being felt by the home insurance industry. While they’re smaller than the typical natural catastrophes the industry suffers from massive wildfires or hurricanes, these secondary perils are becoming more common, and the cost is adding up.

With home insurance prices already on the rise, additional damage doesn’t help

Among the most obvious initial signs of the impact of the climate crisis has been the increasing cost of property coverage associated with more frequent and severe natural disasters.

As the risk climbs, many major insurers have been stepping away from some markets, such as when Allstate and State Farm drew out of offering California fire insurance coverage. Similarly in Florida and Louisiana, smaller insurers have either withdrawn or collapsed altogether due to the recent large hurricanes.

Though the main storms are problematic enough, it is secondary weather events that are piling the expenses even higher. They are helping to make sure that premiums that have already skyrocketed push just that much higher and potentially out of reach of some property owners.

Kitty cat storm costs are expensive

From 1989 to 2022, the losses associated with kitty cat storms have increased an average of 9 percent per year, according to the Aon home insurance company. Last year alone, this type of weather event brought on over $50 billion in total insured losses. That represents about twice the cost of Hurricane Ian, which struck the US in 2022.

Though these storms don’t lead to much more than a few billion in damage at a time, the fact that they are increasingly commonplace means that they are becoming an expense that is painful to the coverage industry.