The bill will provide a weekly supplement to family members of essential workers who die from the virus. The New Jersey Senate has just passed a bill for providing COVID-19 dependent benefits supplements when essential workers in the state die from having the coronavirus. SB 2476 passed on Monday by a vote of 38-1 and will use the NJ Second Injury Fund. Essential workers whose dependents would qualify should the worst happen from coronavirus infection include fire, police and other first responders. They also include medical and other health care…

Read MoreCategory: Workers Compensation

Workers comp insurance companies reporting live insurance news along with consumer friendly stype of articles posted daily.

Workers compensation insurance market starts to feel the COVID-19 pinch

The coronavirus is now making itself felt in this additional part of the industry. Workers compensation insurance companies are now working quickly to keep up with the sudden influx of claims resulting from the coronavirus pandemic. This has been made all the more complex as the regulatory landscape shifts throughout the country. Many states have been changing the regulations to which the workers compensation insurance companies must adhere in the face of COVID-19. For instance, the state commission for this coverage gave its unanimous approval to repeal a controversial emergency…

Read MoreThe Differences Between State Funded and Competitive Workers’ Comp

As a business owner, the last thing you would want is for an employee to get hurt at work. However, if you run a business long enough, an accident is bound to happen eventually, especially if you work in a high-risk industry. When an employee is injured on the job, they’ll have medical expenses that need to be paid, they may not be able to work while they recover, and in worst-case scenarios, they may sue you for a settlement. Fortunately, this is where workers’ compensation insurance comes into play.…

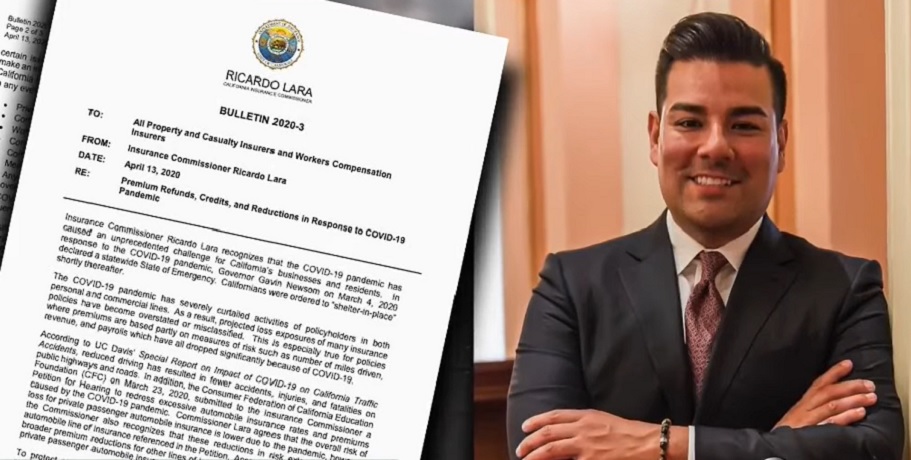

Read MoreCalifornia Insurance Commissioner orders premiums returned to businesses

Ricardo Lara has told insurers to return premiums on six lines of personal and commercial coverage. California Insurance Commissioner Ricardo Lara has ordered insurers to return premiums from certain lines to businesses and consumers. This has raised pressure on those insurers to take larger steps to reduce customer financial burden caused by COVID-19. Lara has ordered insurers to return premiums paid for March, April, and possibly May as well. The California Insurance Commissioner’s order applies to six different coverage lines. These include passenger and commercial auto, commercial multi-peril, workers compensation,…

Read MoreWashington Insurance Commissioner Kreidler fines Starbucks insurer $24 million

The state commissioner ordered the coffee chain’s insurer to pay taxes, penalties and interest. Washington Insurance Commissioner Mike Kreidler ordered a Starbucks owned insurer to pay almost $24 million in fines. The insurance company is required to pay the total amount in taxes, penalties and interest. The full amount of the fine is the result of Starbucks’ insurer’s alleged unauthorised insurance sales. If, when all is said and done, Starbucks is required to pay the complete amount the Washington Insurance Commissioner, it would approach $24 million. This would be the…

Read MorePennsylvania workers compensation insurance implements important filing changes

The state has made several large changes to help reduce the odds of filing of loss cost errors. The Pennsylvania workers compensation insurance system has undergone considerable changes that have now gone into effect. According to the state Insurance Commissioner Jessica Altman as well as Labor and Industry Secretary Jerry Oleksiak, their offices have come to agreements with two major insurers and with the Pennsylvania Compensation Rating Bureau (P.C.R.B.). Together, the organizations hope this will substantially reduce the instance of filing of loss cost errors. These errors to filing of…

Read MoreWorkers compensation technology is reducing claims frequency

The use of tech within this insurance space is making positive changes to the market, says a new report. Workers compensation technology is proving exceptionally advantageous to the insurance market in terms of positive and sizeable changes, said an expert’s report. The tech is promoting reduced claims frequency, which is sending rates downward. The fewer the claims insurance companies receive, the less they must often charge for coverage. “We think it’s due to insurance companies doing better on the claims of their policyholders by using technology to drive down the…

Read More