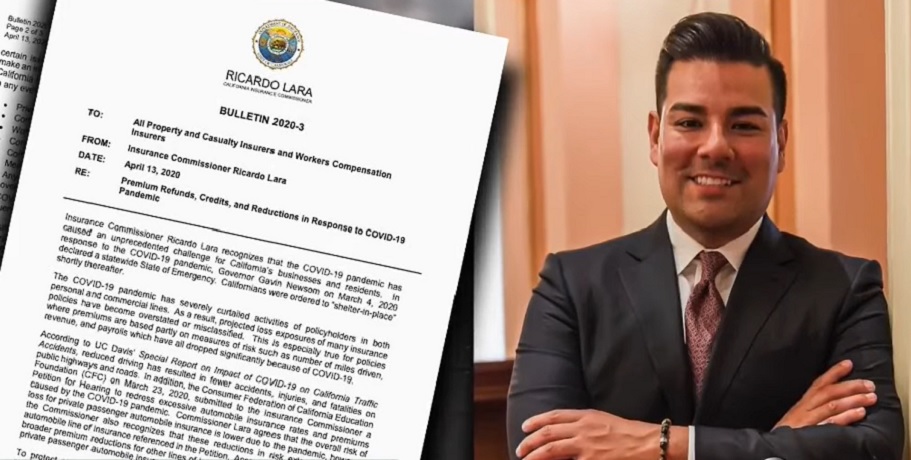

Commissioner Lara’s Reforms to Rescue California’s Property Market In a bid to rescue California’s beleaguered property market, Insurance Commissioner Ricardo Lara has announced a series of reforms aimed at addressing the growing crisis in the state’s insurance sector. The situation has reached a critical point, with many insurers either pausing or severely limiting new policies, particularly in high-risk areas prone to wildfires. The Roots of the Crisis The current crisis is partly rooted in the 1988 voter-passed Proposition 103, which mandates that insurance companies obtain approval from the California Department…

Read MoreCategory: California Insurance

The Rising Tide of Uninsured Americans and the Looming Threat of ACA Subsidies Ending in 2026

Uninsured Americans Rise to 27.1 Million in Early 2024, CDC Reports The latest figures from the Centers for Disease Control and Prevention (CDC) are sounding alarms across the healthcare landscape. More than 8% of Americans were uninsured during the first months of 2024, a significant uptick from the record-low uninsured rates observed in the wake of the COVID-19 pandemic. According to the CDC’s National Health Interview Survey, an estimated 27.1 million Americans of all ages lacked health insurance by March 2024. This marks an increase of 3.4 million uninsured individuals…

Read MoreJapan’s Heat Stroke Insurance Boom Amid Record Temperatures Could Signal New Trends for US Market

With record temperatures soaring above 40°C (104°F) in various locations, Japan has experienced a surge in heat-related illnesses this summer. This unprecedented heat wave has led the Japan Meteorological Agency to issue widespread alerts against heatstroke and heat exhaustion, urging residents to stay indoors during peak daylight hours. A Growing Demand for Heat Stroke Insurance The extreme weather has not only impacted daily life but has also driven a significant increase in the demand for heat-related illness insurance. Over 12,000 people were hospitalized across Japan in just one week due…

Read MoreCalifornia Homeowners Face 34% Rate Hike as Allstate Follows State Farm’s Lead in Insurance Shakeup

LOS ANGELES: In a move that mirrors State Farm’s recent actions, Allstate is seeking a substantial increase in its California homeowners insurance premiums. First reported by the Los Angeles Times, Allstate aims to raise rates by an average of 34%, marking the largest rate hike in the state this year. If approved by the California Department of Insurance, this increase will impact over 350,000 policyholders. This latest development follows State Farm’s request for significant rate increases, including a 50% hike for renters and a 30% hike for homeowners. The six-largest…

Read MoreCalifornia Fair Plan Under Fire for Alleged Policy Violations

California Fair Plan Under Fire: Attorney Calls Policies “Criminally Restrictive” The California Fair Plan, designed as a last-resort insurance option for those unable to secure coverage elsewhere, is now under significant scrutiny. An Oakland attorney has spotlighted troubling issues impacting hundreds of thousands of policyholders. According to reporter Shandel Menezes from NBC San Diego, Attorney Dylan Schaffer of the Kerley Schaffer law firm has described the policies under the Fair Plan as “criminally restrictive” and asserts that selling these policies constitutes a misdemeanor under Insurance Code 2083. Schaffer claims that…

Read MoreCalifornia Insurance Commissioner Announces Game-Changing FAIR Plan Reform

LOS ANGELES — In a significant move to address California’s ongoing insurance crisis,unveiled a breakthrough agreement to modernize the California FAIR Plan Association (FAIR Plan), the state’s “insurer of last resort.” This initiative is a key component of Lara’s Sustainable Insurance Strategy, marking the largest insurance reform since Proposition 103 was passed in 1988. Modernizing the FAIR Plan “Modernizing the FAIR Plan is a crucial step in our strategy to stabilize California’s insurance market,” said Commissioner Lara. “It’s critical for Californians to understand that a growing FAIR Plan contributes to…

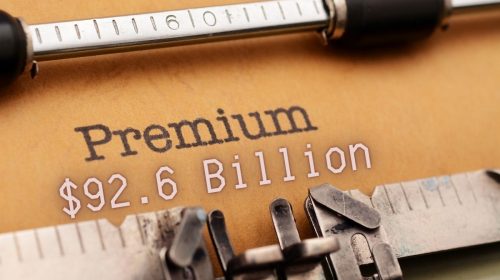

Read MoreState Farm Dominates and Soars to Top of AM Best Rankings with $92.6 Billion in Premiums!

State Farm has once again claimed the top position in AM Best’s rankings of US Property and Casualty (P&C) insurers for 2023, reinforcing its dominance in the market. The company’s total net premiums written (NPW) surged by an impressive 19.1% to $92.6 billion, further widening the gap between itself and its competitors. Dominance in the P&C Sector In the dynamic world of insurance, rankings can be both stable and surprising. Here, we explore the latest shifts among top US Property and Casualty (P&C) insurers, spotlighting substantial changes in Net Premium…

Read More