SB 354 Awaits Vote to Revolutionize Insurance Privacy California is once again putting privacy front and center with Senate Bill 354, the Insurance Consumer Privacy Protection Act (ICPPA) of 2025. Introduced by Senator Monique Limón and supported by Insurance Commissioner Ricardo Lara, the bill seeks to enhance transparency and provide consumers with greater rights over their personal data within the insurance market. However, before these measures can become law, SB 354 must still pass through the California Senate and Assembly and receive the governor’s approval. This legislative milestone has sparked…

Read MoreAuthor: G. Turner

State Farm Proposes 39% Rate Hike for California Umbrella Policies, Sparking Debate

State Farm General Insurance Company has proposed a 39% rate increase for its California Personal Liability Umbrella Program, a move that could impact over 430,000 policyholders statewide. If approved by the California Department of Insurance (CDI), the hike would take effect in August 2025, marking the second major increase in just six months. This development has raised concerns among consumers and advocacy groups, as California’s insurance market continues to deal with rising costs and regulatory challenges. Understanding State Farm’s Rate Hike Proposal The proposed rate hike is part of State…

Read MoreJudge Throws Out Class Action Claiming State Farm Undervalued Home Repairs

Federal Court Dismisses State Farm Class Action Lawsuit Over Alleged Undervaluation of Property Damage Claims A recent decision by a federal court has brought closure, at least for now, to a contentious legal battle against insurance giant State Farm. The dismissal of a class action lawsuit alleging systemic undervaluation of property damage claims in Pennsylvania marks a significant moment in the ongoing debate over insurance claim handling practices and the software tools that power them. At the heart of the dispute was Xactimate, the widely used software for estimating repair…

Read MorePet Insurance Fraud in the US: A Growing Problem Impacting Policyholders and Pets

Pet insurance, once a trusted safety net for unexpected vet bills, is now facing an unsettling challenge in the United States. Fraud within the industry is on the rise, and its implications stretch far beyond the perpetrators and insurers. With insurance fraud costing Americans $308.6 billion annually—that’s $932 for every single person in the US each year—we’re not talking about pocket change. Fraudulent pet insurance claims, in particular, are compounding industry challenges and hitting honest pet owners where it hurts most—in their wallets and their trust. From exaggerated claims to…

Read MoreWhy FEMA’s Flood Insurance Program Is Making Headlines Again

Senate Bill to Extend the National Flood Insurance Program Until 2027: A Game Changer for Flood-Plagued Communities Understanding the shifting landscape of federal flood insurance can feel like deciphering a complex puzzle. But for millions of homeowners living in flood-prone areas, clarity may finally be on the horizon. A newly proposed Senate bill seeks to extend the National Flood Insurance Program (NFIP) through December 31, 2026. This legislation would bring an end to the exhausting cycle of short-term extensions that have burdened the program for years. Here’s why this matters…

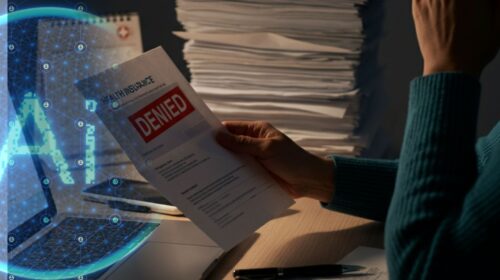

Read MoreAI in Health Insurance Claims Denials Sparks Controversy

Artificial intelligence (AI) has revolutionized many industries, but its use in health insurance claims processing is stirring sharp debate. Health insurance giants like Cigna, Humana, and UnitedHealth Group are facing serious allegations over their use of algorithm-driven systems to deny claims at a staggering rate. With lives at stake and lawsuits piling up, the practice has raised deep ethical and legal concerns. The Allegations Against Industry Leaders The controversy largely centers on accusations that AI algorithms are being used to wrongfully deny claims, often in mere seconds. One lawsuit claims…

Read More37 Insurers Slapped with $20M in Insurance Fines for Breaking New York’s Reporting Rules

New York State Fines Auto Insurers $20 Million Over Reporting Failures The New York State Department of Financial Services (DFS) has handed down $20 million in fines to 37 auto insurers for failing to report new and terminated insurance policies in a timely manner. This enforcement move, announced recently, comes after years of warnings from state regulators about ongoing reporting failures. While the fines aim to improve compliance, the case has raised important questions about outdated reporting systems, consumer protection, and accountability. Why Timely Reporting Matters for Drivers When you…

Read More